Contents:

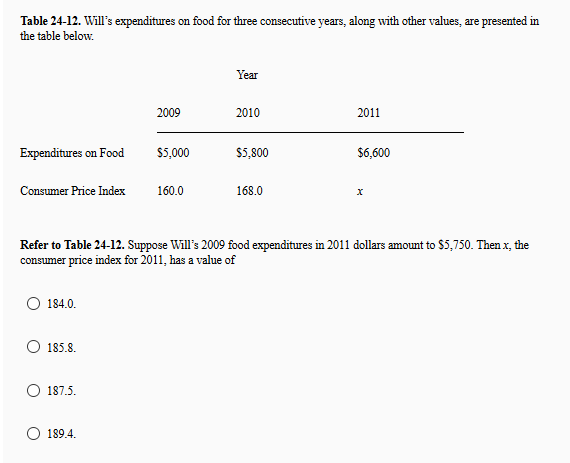

The term ‘work in process’ refers to the ability of a firm to pay its short-term obligations as and when they become due. The two determinants of current ratio, as a measure of liquidity, are current assets and current liabilities. To calculate your firm's current ratio, you need to check all the current liabilities and current assets itemized on the balance sheet.

Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

More meanings of quick ratio

To learn more about this ratio and other important metrics, check out CFI’s course onperforming financial analysis. Deriving from the term ‘remit’ (meaning “to send back”), remittance refers to a sum of money that is sent back or transferred to another party. The term inventories includes stock of raw materials, work in progress and finished goods. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

The quick ratio is useful when analyzing a company's liquidity position. Quick assets are current assets that you can convert into cash within 90 days. For calculating quick assets, stock-in-trade and prepaid insurance are excluded from current assets. The quick ratio of a company is considered conservative because it offers short-term insights , while the current ratio offers long-term insights .

Understanding the Quick Ratio

It means that the company has enough money on hand to pay its obligations. The quick ratio is considered to be one of the most reliable tools to assess the liquidity position of a company. The company's quick ratio is 2.5, meaning it has more than enough capital to cover its short-term debts. This ratio eliminates the closing stock from the calculation, which may not always be necessary to be taken as a liquid, thereby giving a more suitable profile of the company’s liquidity position. You can find the value of current liabilities on the company’s balance sheet. The quick ratio is also known as the acid test ratio, a reference to the fact that it’s used to measure the financial strength of a business.

Concord Wealth Partners Buys New Position in eBay Inc: Is it an … – Best Stocks

Concord Wealth Partners Buys New Position in eBay Inc: Is it an ….

Posted: Thu, 13 Apr 2023 02:03:58 GMT [source]

The acid test ratio in accounting and finance shows how well a company can quickly convert its assets into cash in order to pay off its current liabilities. Cash, cash equivalents, and marketable securities are a company's most liquid assets. It includes anything convertible to cash almost immediately, such as bank balances and checks. A quick ratio of 1.0 means that for every $1 a company has in current liabilities, it also has $1 in quick assets.

Quick Ratio Formula in Accounting with Examples

They also include accounts receivable — money owed to the company by its customers under short-term credit agreements. With a quick ratio of over 1.0, Johnson & Johnson appears to be in a decent position to cover its current liabilities as its liquid assets are greater than the total of its short-term debt obligations. Procter & Gamble, on the other hand, may not be able to pay off its current obligations using only quick assets as its quick ratio is well below 1, at 0.45.

In addition, the quick ratio doesn’t take into account a company’s credit facilities, which can significantly affect its liquidity. Now consider Company B, which has current liabilities of $15,000 and quick assets comprising $10,000 cash and $4,000 of accounts receivable, with customer payment terms of 30 days. For example, suppose Company A has current liabilities of $15,000 and quick assets comprising $1,000 cash and $19,000 of accounts receivable, with customer payment terms of 90 days. The quick ratio is the barometer of a company’s capability and inability to pay its current obligations. Investors, suppliers, and lenders are more interested to know if a business has more than enough cash to pay its short-term liabilities rather than when it does not.

The financial metric does not give any indication about a company's future cash flow activity. Though a company may be sitting on $1 million today, the company may not be selling a profitable good and may struggle to maintain its cash balance in the future. There are also considerations to make regarding the true liquidity of accounts receivable as well as marketable securities in some situations.

Kinsale Capital Group Inc. Reports Insider Stock Sales and … – Best Stocks

Kinsale Capital Group Inc. Reports Insider Stock Sales and ….

Posted: Fri, 14 Apr 2023 05:17:58 GMT [source]

The quick ratio is considered a conservative measure of liquidity because it excludes the value of inventory. Thus it’s best used in conjunction with other metrics, such as the current ratio and operating cash ratio. Quick ratio / acid test ratio should always be analyzed alongside other liquidity ratios, such as current ratio or cash ratio.

Marketable securities are short-term assets that can take a few days to turn into cash. Examples of marketable securities include stocks and money market funds. But also has $1,500 in quick assets, so its quick ratio is 1.5, or $1,500 / $1,000. SaaS owners use these formulas to check their firm's liquidity and financial health. They can use them to identify the shortcomings and take quick corrective actions to keep the business in the green.

When the quick ratio is 1.0 or higher, it indicates that the company is capable of paying all of the current outstanding debts with the cash it has available. For instance, when the company receives bills for the mortgage or rent, utilities, or other expenses , the company has the cash available to pay the bills without having to liquidate assets to cover the expenses. Note that inventory is included in current assets but the quick ratio formula subtracts it out. This can be confusing, so the formula is sometimes rewritten to never include inventory. It can be difficult for businesses to quickly convert inventory to cash. Therefore, a quick ratio gives business owners, financial institutions, investors, and other stakeholders an idea of how easily the business could pay short-term liabilities if it had to do so quickly.

- The current ratio is calculated by dividing the amount of current assets by the amount of current liabilities.

- Cody has a Master's Degree in Business Administration and nearly 10 years of industry experience.

- It can also include short-term debt, dividends owed, notes payable, and income taxes outstanding.

- Our team of reviewers are established professionals with years of experience in areas of personal finance and climate.

Quick assets are assets a company expects to convert to cash in 90 days or less. Current liabilities are obligations the company will need to pay within the next year. In that sense, cash in hand and cash at bank are the most liquid assets.

However, the https://1investing.in/ is not as strict a measure as the cash ratio, which measures the ratio of cash and cash equivalents to current liabilities. The quick ratio is the value of a business’s “quick” assets divided by its current liabilities. Quick assets include cash and assets that can be converted to cash in a short time, which usually means within 90 days. These assets include marketable securities, such as stocks or bonds that the company can sell on regulated exchanges.

- Company B, too, has a $5,000 supplier payment falling due in 10 days.

- Reliance on any information provided on this site or courses is solely at your own risk.

- They are categorized as current assets on the balance sheet as the payments expected within a year.

- This capital could be used to generate company growth or invest in new markets.

But unlike the first company, it has enough cash to meet that supplier payment comfortably — despite its lower quick ratio. Cash equivalents are often an extension of cash as this account often houses investments with very low risk and high liquidity. Only accounts receivable that can be collected within 90 days should be included. If you have accounts receivable that it’s not possible to collect within 90 days, ensure that these aren’t counted, or it could skew your result. The current ratio and quick ratio has been at a sufficient level only during the pre 1997 era. The quick ratio is also over 1, which is reflective of a good cash and cash equivalent position.