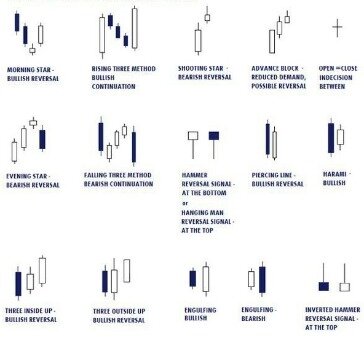

As seen in the illustration above, the second candle completely overwhelms the prior candle. For a pattern to qualify as bullish engulfing, the high of the second candle should hit higher prices than the high of the prior candle. All ranks are out of 103 candlestick patterns with the top performer ranking 1. "Best" means the highest rated of the four combinations of bull/bear market, up/down breakouts.

Risk management tools like stop-losses can be used to minimise risk. Remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and goals. Alternatively, if you’d like to learn more about financial markets, technical analysis and candlesticks specifically, you can visit the IG Academy. Engulfing candlesticks are just one part of a technical analysis strategy. They are usually used alongside volume indicators – such as the RSI – that can show the strength of a trend. In such a case, the volume of trading has not changed significantly; rather, the engulfing candle has been brought about by minor fluctuations in trading volumes.

US traders welcome at these brokers:

The second candle, on the other hand, has longer wicks and a real body that engulfs the body of the previous candle. In an upward price trend, look for a white candle followed by a black candle the body of which overlaps the body of the white

candle. By overlaps, I mean the body of the black candle has an open above the prior close and a close below the prior open. The black body is taller than the white body,

and everything appears in an upward price trend. Just look at a picture of the ideal bearish engulfing candlestick above.

In the chart, the RSI indicator shows that the values have gone into the oversold zone. The MACD indicator crosses above the zero line, which is also a reversal signal. All content on this website, including dictionary, thesaurus, literature, geography, https://trading-market.org/bullish-engulfing-pattern-definition/ and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

Bullish engulfing candles explained

Both candlesticks should have fairly large bodies and the shadows are usually, but not necessarily, small or nonexistent. The white candlestick must open below the previous close and close above the midpoint of the black candlestick's body. A close below the midpoint might qualify as a reversal, but would not be considered as bullish.

It occurs when a small bearish candlestick is followed by a larger bullish candlestick that "engulfs" the previous candle. These indicators can help identify areas where the trend may potentially reverse into a downward or upward trend. For example, if the RSI indicates a bullish divergence and the MACD breaks the zero-level upside, it could signal a shift toward a bullish trend. After rejection at $43,000 on April 21, Bitcoin price plunged to $37,386 on May 1, 2022. On May 5, a bullish engulfing candlestick appeared on the cryptocurrency’s candlestick chart as the price briefly increased above the $40,000 mark.

Understanding Bullish Engulfing Candlesticks

The first candlestick shows that the bulls were in charge of the market, while the second shows that bearish pressure pushed the market price lower. The second period will open higher than the previous day but finish significantly lower. Support and resistance levels are important in trading because they help you identify entry and exit points for profitable trades.

Using a previous support or resistance level as a stop loss will result in a larger stop loss. But it also means there’s less likelihood of getting stopped out too early in the trade, i.e., it can give the trade more breathing room. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter.

White/white and white/black bullish harami are likely to occur less often than black/black or black/white. In Jan-00, Sun Microsystems (SUNW) formed a pair of bullish engulfing patterns that foreshadowed two significant advances. The first formed in early January after a sharp decline that took the stock well below its 20-day exponential moving average (EMA). An immediate gap up confirmed the pattern as bullish and the stock raced ahead to the mid-forties. After correcting to support, the second bullish engulfing pattern formed in late January.

Bullish Engulfing candle that considers the length of the candle and the position of the candle in a downtrend. Bearish Engulfing candle that considers the length of the candle and the position of the candle in an uptrend. As you will find out, there are many of this patterns in the market but not all of them are relevant. Indeed, analysts believe that for a real engulf to happen, the first candle needs to be small and the second candle very large.

These are strong reversal patterns and do not require further bullish confirmation, beyond the long white candlestick on the third day. After the advance above 160, a two-week pullback followed and the stock formed a piecing pattern (red arrow) that was confirmed with a large gap up. Micromuse (MUSE) declined to the mid-sixties in Apr-00 and began to trade in a range bound by 33 and 50 over the next few weeks. After a 6-day decline back to support in late May, a bullish harami (red oval) formed.

- Then, a bullish inverted hammer candlestick appears, suggesting a possible reversal.

- It is formed of a short red candle next to a much larger green candle.

- There is a reversal in the price pattern from a downward to an upward trend.

- The candlestick formed on 7 September opened below the closing price of the previous day, but closed above the opening price of 6 September and 7 September.

- This article will be divided into two parts- first part will deal with the bullish engulfing pattern; the second part will go over the bearish engulfing candlestick pattern.

The move showed that the bulls were still alive and another wave in the uptrend could occur. Candle B

acts as another bearish reversal, but C acts as a continuation of the uptrend. The candlestick formed on 7 September opened below the closing price of the previous day, but closed above the opening price of 6 September and 7 September.

What Is a Candlestick Chart and How Do You Read One? – TheStreet

What Is a Candlestick Chart and How Do You Read One?.

Posted: Thu, 24 Feb 2022 08:00:00 GMT [source]

In the article above has been shown that bullish and bearish engulfing candlestick patterns could be formed in different ways and combinations. What matters is what stands behind those patterns and it is pure price action and market psychology. It is important to understand the principles behind those and to be able to apply them correctly in an ever-changing environment. A bullish engulfing candlestick pattern is a set of two candlesticks that indicate a bullish reversal in a security’s price. In a bullish engulfing pattern, the second candlestick closes higher than the opening price of the previous day after opening at a lower price than the previous day’s close.

Indicator that changes the bar's color to green if there is a Bullish Engulfing or Red if there a Bearish Engulfing Patterns. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. In addition to the two patterns, there is another one that is known as a Last Engulfing Pattern. Stay on top of upcoming market-moving events with our customisable economic calendar. Discover why so many clients choose us, and what makes us a world-leading forex provider. There is a gap down, but the bears aren’t able to push the price very far before the bulls take command.

The body of the bullish candlestick should completely cover the body of the bearish one, but the size of the shadows doesn't matter. For starters, the bullish engulfing pattern can be found on any time frame but is most commonly used on daily or weekly charts. To qualify as a true bullish engulfing pattern, the second candlestick should close above the midpoint of the first candlestick’s body. This pattern indicates that the bears are losing control of the market and that the bulls are taking over.